Best Mortgage Rate Tools to Buy in March 2026

Calculated Industries 3405 Real Estate Master IIIx Residential Real Estate Finance Calculator | Clearly-Labeled Function Keys | Simplest Operation | Solves Payments, Amortizations, ARMs, Combos, More

-

DEDICATED KEYS FOR FAST, CONFIDENT FINANCIAL SOLUTIONS ANYTIME.

-

INSTANTLY ANSWER CLIENTS' FINANCE QUESTIONS, BOOSTING YOUR SALES.

-

USER-FRIENDLY, LABELED KEYS SIMPLIFY COMPLEX LOAN CALCULATIONS.

Calculated Industries 43430 Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

EASILY CALCULATE LOAN OPTIONS TO EMPOWER BUYERS AND BOOST SALES!

-

PRE-QUALIFY CLIENTS SWIFTLY, ENSURING THEY SEE ONLY AFFORDABLE HOMES.

-

PROVIDE INSTANT, ACCURATE FINANCIAL ANSWERS TO IMPRESS AND CLOSE DEALS.

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

-

SIMPLIFIES MORTGAGE TERMS FOR QUICK CLIENT DECISIONS.

-

BOOSTS PROFESSIONALISM; IMPRESS CLIENTS WITH ACCURATE ANSWERS.

-

PRE-QUALIFY BUYERS SWIFTLY; SHOW ONLY AFFORDABLE PROPERTIES.

Victor 6500 Executive Desktop Loan Calculator, 12-Digit LCD

- EXTRA-LARGE 12-DIGIT DISPLAY FOR EASY VISIBILITY AND USE.

- LOAN WIZARD SIMPLIFIES CALCULATIONS FOR QUICK DECISION-MAKING.

- AUTOMATIC TAX KEYS STREAMLINE TAX-RELATED COMPUTATIONS EFFORTLESSLY.

Calculated Industries 3430 Qualifier Plus IIIfx Advanced Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

SIMPLIFIED MORTGAGE TERMS EMPOWER CLIENTS TO MAKE INFORMED DECISIONS.

-

GAIN PROFESSIONALISM AND CONFIDENCE, CLOSING MORE REAL ESTATE DEALS.

-

PRE-QUALIFY BUYERS EASILY, ENSURING EVERY CLIENT VIEWS AFFORDABLE HOMES.

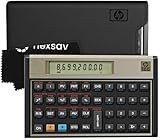

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys – RPN Desktop Calculator for Finance, Accounting & Real Estate – Includes Case + Cloth

-

TRUSTED SINCE 1981: INDUSTRY-STANDARD TOOL FOR FINANCE PROFESSIONALS.

-

120+ FUNCTIONS: VERSATILE CALCULATIONS FOR ALL FINANCIAL SCENARIOS.

-

RPN EFFICIENCY: FASTER DATA ENTRY WITH LESS KEYSTROKES, NO FORMULAS.

Calculated Industries 3400 Pocket Real Estate Master Financial Calculator

- CALCULATE PAYMENTS EFFORTLESSLY WITH INSTANT LOAN BREAKDOWNS!

- PROJECT FUTURE VALUES TO BETTER PLAN YOUR FINANCIAL GOALS!

- SIMPLIFY DATE CALCULATIONS WITH OUR ADVANCED DATE MATH FUNCTION!

If you're looking to purchase a home in Hawaii, it's essential to stay updated on the current mortgage rates to make an informed decision. Here are some insights into the best mortgage rates in Hawaii from various lenders:

American Savings Bank:

- 15-Year Fixed: 5.25% interest rate, 2.00 points, 5.69% APR.

- 30-Year Fixed: 6.125% interest rate, 1.75 points, 6.375% APR.

- 5-Year ARM: 5.625% interest rate, 2.00 points, 7.066% APR.

Bank of Hawaii:

- 15-Year Fixed: 6.00% interest rate, 0.875 points, 6.138% APR.

- 30-Year Fixed: 6.25% interest rate, 1.875 points, 6.43% APR.

- 5-Year ARM: 6.00% interest rate, 0.875 points, 7.208% APR.

Central Pacific Bank:

- 15-Year Fixed: 5.375% interest rate, 2.00 points, 5.823% APR.

- 30-Year Fixed: 6.00% interest rate, 2.25 points, 6.302% APR.

- 5-Year ARM: 7.00% interest rate, 0 points, 7.849% APR.

First Hawaiian Bank:

- 15-Year Fixed: 5.375% interest rate, 2.125 points, 5.90% APR.

- 30-Year Fixed: 6.125% interest rate, 2.00 points, 6.44% APR.

- 5-Year ARM: 5.75% interest rate, 2.00 points, 7.44% APR.

Hawaii State Federal Credit Union:

- 15-Year Fixed: 5.375% interest rate, 1.625 points, 5.78% APR.

- 30-Year Fixed: 6.25% interest rate, 1.50 points, 6.494% APR.

- 5-Year ARM: 6.00% interest rate, 0.875 points, 7.515% APR.

HawaiiUSA Federal Credit Union:

- 15-Year Fixed: 6.25% interest rate, 1.50 points, 6.693% APR.

- 30-Year Fixed: 6.625% interest rate, 1.50 points, 6.90% APR.

Programs and Benefits

Hawaii also offers several programs to assist homebuyers:

- Down Payment Assistance Loan Program: Helps first-time homebuyers cover down payments.

- Mortgage Booster: Provides additional financial support for qualifying buyers.

Considerations

- Rates are influenced by various factors, including credit score, loan amount, and down payment.

- It's crucial to compare the APR (Annual Percentage Rate) since it includes both the interest rate and additional fees.

- Adjustable-rate mortgages (ARMs) may offer lower initial rates but can increase after the fixed period ends.

Staying informed about the current mortgage rates and available programs can help you make the best financial decision when purchasing a home in Hawaii.