Best Mortgage Rate Tools to Buy in February 2026

Calculated Industries 3405 Real Estate Master IIIx Residential Real Estate Finance Calculator | Clearly-Labeled Function Keys | Simplest Operation | Solves Payments, Amortizations, ARMs, Combos, More

-

DEDICATED FUNCTION KEYS FOR INSTANT FINANCIAL ANSWERS ANYTIME.

-

QUICKLY SOLVE CLIENT QUESTIONS TO BOOST PROFESSIONALISM AND SALES.

-

USER-FRIENDLY LABELS ENSURE EASY NAVIGATION FOR FAST LOAN OPTIONS.

Calculated Industries 43430 Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

- CLEAR MORTGAGE TERMS SIMPLIFY CLIENT CONVERSATIONS AND BOOST SALES.

- PRE-QUALIFY BUYERS QUICKLY, SHOWING PROPERTIES WITHIN THEIR BUDGET.

- INSTANTLY CALCULATE VARIOUS LOAN OPTIONS TO EMPOWER CLIENT CHOICES.

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

-

EASILY PRE-QUALIFY CLIENTS AND SHOW ONLY AFFORDABLE PROPERTIES.

-

IMPRESS CLIENTS WITH FAST, ACCURATE MORTGAGE FINANCE CALCULATIONS.

-

SIMPLIFY LOAN OPTIONS WITH JUST ONE BUTTON FOR DIVERSE FINANCING.

Calculated Industries 3430 Qualifier Plus IIIfx Advanced Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

INDUSTRY-STANDARD KEYS SIMPLIFY MORTGAGE CALCULATIONS FOR CLIENTS.

-

ENHANCE PROFESSIONALISM AND CLOSE MORE SALES WITH ACCURATE ANSWERS.

-

EASILY PRE-QUALIFY BUYERS AND EXPLORE LOAN OPTIONS IN REAL TIME.

Victor 6500 Executive Desktop Loan Calculator, 12-Digit LCD

- EXTRA LARGE 12-DIGIT ANGLED DISPLAY FOR EASY READABILITY.

- LOAN WIZARD CALCULATES ANY LOAN VARIABLE WITH SPEED AND EASE.

- AUTOMATIC TAX KEYS SIMPLIFY TAX CALCULATIONS EFFORTLESSLY.

Calculated Industries 3400 Pocket Real Estate Master Financial Calculator

- CALCULATE LOAN PAYMENTS INSTANTLY: PRINCIPAL & INTEREST OPTIONS!

- TRACK REMAINING BALANCES EASILY FOR INFORMED FINANCIAL DECISIONS.

- UTILIZE DATE MATH FOR PRECISE FUTURE VALUE PREDICTIONS!

HP 12C Financial Calculator – 120+ Functions: TVM, NPV, IRR, Amortization, Bond Calculations, Programmable Keys – RPN Desktop Calculator for Finance, Accounting & Real Estate – Includes Case + Cloth

-

TRUSTED BY EXPERTS SINCE 1981 – PERFECT FOR FINANCE PROFESSIONALS.

-

120+ FINANCIAL FUNCTIONS – FAST, ACCURATE CALCULATIONS FOR COMPLEX TASKS.

-

PROGRAMMABLE & COMPACT – AUTOMATE TASKS AND FIT EASILY ON ANY DESK.

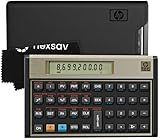

HP 12C Financial Calculator - Black/Gold

- TRUSTED BY PROFESSIONALS FOR OVER 40 YEARS IN FINANCE.

- FAST, ACCURATE CALCULATIONS BOOST CONFIDENCE IN HIGH-STAKES DEALS.

- INDUSTRY STANDARD FOR REAL ESTATE, BANKING, AND FINANCE EXPERTS.

HP 10bII+ Financial Calculator – 100+ Functions for Business, Finance, Accounting, Statistics & Algebra – College & High School Calculator, Exam Approved for SAT, AP, PSAT – Includes Case & Cloth

- 100+ FUNCTIONS FOR INSTANT FINANCIAL SOLUTIONS

- EXAM APPROVED: USE ON SAT, PSAT, AND AP TESTS

- USER-FRIENDLY DESIGN WITH DEDICATED KEYS

When looking for the best mortgage rates in Illinois, it's important to compare offerings from multiple lenders to find the most competitive rates and terms. Here are some of the current trends and tips to help you secure the best mortgage rates in Illinois.

Current Mortgage Rates

- 30-Year Fixed-Rate Mortgage: The average rate for a 30-year fixed-rate mortgage in Illinois is around 7.31%.

- 15-Year Fixed-Rate Mortgage: For those opting for a shorter term, the average rate for a 15-year fixed-rate mortgage is approximately 6.70%.

- Adjustable-Rate Mortgages (ARMs): Rates for adjustable-rate mortgages can vary, with a 5/6 ARM averaging around 7.978%.

Key Lenders

- Rocket Mortgage: Known for its streamlined online application process and competitive rates. It’s one of the top lenders in the state and provides a range of mortgage options.

- AmeriSave: Offers attractive rates, particularly for borrowers with high credit scores. It provides a variety of loan types, including conventional and government-insured loans.

- Veterans United: A great option for eligible veterans, offering low interest rates and flexible qualification requirements.

Tips for Securing the Best Rates

- Boost Your Credit Score: Higher credit scores generally secure better interest rates. Aim to improve your credit score by paying down debts and making timely payments.

- Lower Your Debt-to-Income Ratio: Reducing your debt relative to your income can help you qualify for lower rates. Consider paying off high-interest debts or increasing your income.

- Shop Around: Compare rates from multiple lenders. Online comparison tools can help you quickly see different offers.

- Consider Mortgage Points: Paying for mortgage points can reduce your interest rate. This involves an upfront payment in exchange for a lower rate over the life of the loan.

- Choose the Right Loan Type: Depending on your situation, FHA or VA loans might offer more favorable terms compared to conventional loans.

Illinois-Specific Programs

- IHDAccess Repayable: The Illinois Housing Development Authority offers programs like IHDAccess Repayable, which provides up to $10,000 in down payment assistance. This can be particularly beneficial for first-time homebuyers.

By taking these steps and staying informed about current market trends, you can increase your chances of securing the best mortgage rate available in Illinois. Always read the fine print and understand all fees and conditions associated with the mortgage offers you consider.