Best Down Payment Options to Buy in March 2026

Calculated Industries 3405 Real Estate Master IIIx Residential Real Estate Finance Calculator | Clearly-Labeled Function Keys | Simplest Operation | Solves Payments, Amortizations, ARMs, Combos, More

-

QUICKLY PROVIDE FINANCIAL ANSWERS WITH DEDICATED FUNCTION KEYS.

-

INSTANTLY SOLVE CLIENT FINANCE QUESTIONS AND BOOST PROFESSIONALISM.

-

EASY-TO-USE CALCULATOR WITH REAL ESTATE FINANCE TERMS FOR CLARITY.

Calculated Industries 3400 Pocket Real Estate Master Financial Calculator

- EFFORTLESSLY TRACK LOAN AMORTIZATION AND REMAINING BALANCES.

- INSTANT CALCULATIONS FOR PRINCIPAL, INTEREST, AND TOTAL PAYMENTS.

- ACCURATE FUTURE VALUES WITH SMART DATE MATH FUNCTIONS.

Calculated Industries 3415 Qualifier Plus IIIx Advanced Real Estate Mortgage Finance Calculator | Simple Operation | Buyer Pre-Qualifying | Solves Payments, Amortization, ARMs, Combos, FHA, VA, More

-

USER-FRIENDLY DESIGN WITH CLEAR MORTGAGE TERMS FOR EASY UNDERSTANDING.

-

ENHANCE CLIENT TRUST WITH QUICK, ACCURATE FINANCIAL SOLUTIONS.

-

PRE-QUALIFY BUYERS EFFORTLESSLY WITH DEDICATED FINANCIAL KEYS.

Calculated Industries 3430 Qualifier Plus IIIfx Advanced Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

- INDUSTRY-STANDARD LABELS MAKE FINANCE TERMS EASY TO UNDERSTAND.

- QUICKLY PRE-QUALIFY CLIENTS FOR AFFORDABLE PROPERTY OPTIONS.

- INSTANTLY CALCULATE VARIOUS LOAN TYPES AND OPTIONS FOR CLIENTS.

Victor 6500 Executive Desktop Loan Calculator, 12-Digit LCD

- EXTRA-LARGE 12-DIGIT DISPLAY FOR EASY READABILITY.

- CALCULATE LOANS EFFORTLESSLY WITH THE LOAN WIZARD FEATURE.

- VERSATILE INPUT: ANY THREE VARIABLES TO FIND THE FOURTH!

Calculated Industries 43430 Qualifier Plus IIIfx Desktop PRO Real Estate Mortgage Finance Calculator | Clearly-Labeled Keys | Buyer Pre-Qualifying | Payments, Amortizations, ARMs, Combos, FHA/VA, More

-

SIMPLIFY MORTGAGE TERMS: CLEARLY LABELED KEYS FOR EASY CLIENT COMMUNICATION.

-

BOOST PROFESSIONALISM: IMPRESS CLIENTS WITH FAST, ACCURATE FINANCIAL ANSWERS.

-

STREAMLINE PRE-QUALIFICATION: ENTER INCOME AND DEBT TO SHOW AFFORDABLE OPTIONS.

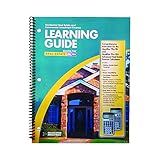

Calculated Industries 2128 Qualifier Plus Training Program Workbook for Qualifier Plus IIIx and IIIfx Real Estate Finance Calculators | 3 Modules: Basic, Comprehensive, Intro to Commercial Investment

-

MASTER ADVANCED FINANCE FUNCTIONS WITH OUR EASY-TO-USE WORKBOOK.

-

GAIN CONFIDENCE IN HANDLING COMPLEX MORTGAGE SCENARIOS EFFORTLESSLY.

-

IMPRESS CLIENTS WITH QUICK, ACCURATE ANSWERS TO FINANCE QUESTIONS.

HP 12CP Financial Calculator

- OVER 120 FUNCTIONS FOR FINANCE AND MATH AT YOUR FINGERTIPS!

- SMALL, PORTABLE DESIGN FOR ON-THE-GO EFFICIENCY!

- ENJOY LONG BATTERY LIFE FOR UNINTERRUPTED USE!

HP 2716570 10bII+ Financial Calculator, 12-Digit LCD

- OVER 100 FUNCTIONS FOR ADVANCED CALCULATIONS WITHOUT HASSLE.

- USER-FRIENDLY DESIGN WITH MINIMAL KEYSTROKES FOR EFFICIENCY.

- APPROVED FOR SAT AND AP TESTS-BOOSTS STUDENT PERFORMANCE!

When buying a home, one of the biggest expenses that you’ll have to come up with right away is the down payment. Banks and mortgage lenders will need the down payment before they’ll lend you the rest of the purchase price for any house you choose. One of the biggest home buying mistakes that people make is not saving early enough for their down payment. This causes unnecessary delays in buying the house of your dreams. The second biggest mistake is not checking your credit score before applying for a mortgage. Lenders require a solid credit score to buy a house. But once your credit score is high enough you’re ready to make the down payment on your home.

What Is A Down Payment?

A down payment is the money that a home buyer needs to pay towards the purchase price of a home. The down payment is always made with cash funds. You can’t charge a down payment on a credit card. The down payment represents a certain percentage the the entire amount Of the purchase. Depending on where you get for mortgage, you’ll need to make a down payment of a certain percentage of the property that you’re intending to buy. Since the down payment represents part of the purchase price, the more you put down as a down payment, the less you’ll have to finance.

Minimum Down Payments

When you buy a home, your mortgage lender will require a specific minimum down payment. This is the very least they’ll be able to accept in order to offer you the mortgage loan. Typical minimum down payments can range from between 3% and 25%. The minimum amount that you’re required to put down on a home purchase we’ll be dictated by your lender. It’s important that you save enough for your down payment so that you can meet the qualifications of as many lenders as possible. For that reason and others you should strive for a minimum down payment of 20%.

Benefits Of 20% Down Payment

As mentioned, most lenders require a minimum down payment of 20%. There are additional benefits to making a 20% down payment. The major benefit is not having to pay private mortgage insurance, or PMI. Private mortgage insurance is a type of guarantee insurance in case you can’t make the payments on your mortgage each month. Private mortgage insurance premiums are added to your monthly payments each month. If you put at least 20% down on your home, you are considered invested enough in the purchase so that you don’t also have to pay private mortgage insurance. This can significantly reduce your monthly mortgage payments.

How Much Should Your Home Down Payment Be?

You should strive to put at least 20% down on the purchase of your new home. This will save you from having to pay for private mortgage insurance. If you fail to make that 20% minimum, you will have to wait until the loan to value ratio on your home is 80/20. This can take several years to achieve. In the meantime, you would have paid thousands of dollars just for private mortgage insurance, which doesn’t give you any benefits. Your home down payment should be at least 20% so that you can have your monthly payments going towards paying off the principal balance instead of toward PMI.

Now that you understand how much down payment you need to purchase a home, it maybe time to talk to potential mortgage lenders to see if you can qualify for the home of your dreams.