Best Real Estate Investments in West Virginia to Buy in March 2026

Real Estate Finance and Investments: Risks and Opportunities Edition 5.3

The Millionaire Real Estate Investor

- EXPERT INSIGHTS ON MARKET TRENDS FOR INFORMED INVESTMENT DECISIONS.

- COMPREHENSIVE GUIDES ON PROPERTY VALUATION AND FINANCING OPTIONS.

- PROVEN STRATEGIES TO MAXIMIZE ROI IN REAL ESTATE INVESTMENTS.

The Book on Rental Property Investing: How to Create Wealth and Passive Income Through Smart Buy & Hold Real Estate Investing

Buy, Rehab, Rent, Refinance, Repeat: The BRRRR Rental Property Investment Strategy Made Simple

Real Estate Finance & Investments (Real Estate Finance and Investments)

Real Estate Investment and Finance: Strategies, Structures, Decisions (Wiley Finance)

ISE Real Estate Finance & Investments

- COMPREHENSIVE INSIGHTS ON GLOBAL REAL ESTATE FINANCE STRATEGIES.

- UP-TO-DATE MARKET TRENDS AND INVESTMENT ANALYSIS TECHNIQUES.

- ESSENTIAL RESOURCE FOR MASTERING REAL ESTATE FINANCE CONCEPTS.

The Book on Investing In Real Estate with No (and Low) Money Down: Creative Strategies for Investing in Real Estate Using Other People's Money (BiggerPockets Rental Kit 1)

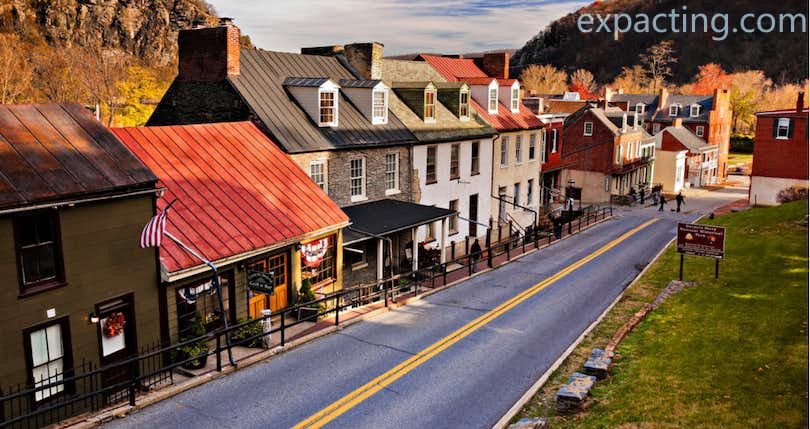

West Virginia can be a good place to invest in real estate for various reasons. Firstly, the cost of living in West Virginia is considerably lower compared to many other states, making it an attractive option for real estate investors looking for affordable properties. This lower cost of living translates into lower property prices, allowing investors to potentially find good deals and maximize their return on investment.

The state of West Virginia also offers a desirable quality of life, particularly for those who enjoy outdoor activities. With its beautiful landscapes and abundance of recreational opportunities, the state attracts tourists and residents alike. This can be an advantage for investors looking to tap into the growing tourism industry by purchasing properties for vacation rentals or short-term leasing.

Furthermore, West Virginia has a relatively stable real estate market, experiencing steady appreciation in property values over the years. This stability can provide a sense of security for investors, making it an appealing location for long-term investments. Additionally, the state has relatively lenient zoning regulations, providing investors with more flexibility in developing or converting properties.

The oil and gas industry is also a significant part of West Virginia's economy, which can indirectly benefit the real estate market. Oil and gas projects can lead to an influx of job opportunities, attracting workers who may require housing options, thus increasing demand for rental properties.

However, it is important to note that like any investment, there are potential risks and considerations to be aware of. The state of West Virginia has experienced population decline in recent years, which can affect the demand for real estate. Additionally, certain areas may have limited economic and employment opportunities, making it crucial to thoroughly research the local market before making any investment decisions.

To summarize, investing in real estate in West Virginia can be a good option due to its affordable property prices, attractive quality of life, stable market, and potential opportunities in the tourism and energy sectors. However, it is crucial to conduct thorough research and analysis before making any investment decisions to ensure a successful and profitable venture.

Are there any specific demographic trends in West Virginia that may impact real estate investments?

Yes, there are specific demographic trends in West Virginia that may impact real estate investments. Some key demographic trends are:

- Aging Population: West Virginia has one of the highest median ages in the United States, with a significant portion of the population nearing or reaching retirement age. This can create opportunities for real estate investments in senior housing facilities, retirement communities, and assisted living facilities.

- Population Decline: West Virginia has experienced a declining population for several years. This trend can impact the demand for housing and potentially decrease property values. Investors should consider the economic reasons behind the population decline and assess whether it might affect the demand for real estate in certain areas.

- Outmigration of Younger Population: West Virginia also faces outmigration, as many younger individuals leave the state in search of better job opportunities or education. This can lead to a reduced demand for housing and affect the rental market. Real estate investors should be aware of areas with high outmigration rates and adjust their investment strategies accordingly.

- Rural-Urban Divide: There is a significant divide between rural and urban areas in West Virginia. Urban areas tend to have higher population growth and economic opportunities, while rural areas face declining populations and limited job prospects. Real estate investors should consider the location of their investments and the potential differences in market dynamics between rural and urban areas.

- Energy Industry Influence: West Virginia has a significant presence of coal and natural gas industries, which can impact real estate investment opportunities. Changes in legislation or market dynamics within the energy sector may affect the demand for housing and commercial properties in areas closely tied to these industries.

Overall, understanding and monitoring these demographic trends can help real estate investors make informed decisions about where and how to invest in West Virginia.

How does West Virginia's real estate market compare to neighboring states?

The real estate market in West Virginia is generally considered to be more affordable compared to its neighboring states. The median home prices in West Virginia are typically lower than in states like Pennsylvania, Ohio, Maryland, and Virginia. Additionally, the cost of living in West Virginia is generally lower, which also impacts the real estate market.

However, it is important to note that the real estate market can vary within different regions of West Virginia and neighboring states. For example, areas near major cities or desirable locations may have higher home prices compared to more rural or less in-demand areas. Urban areas, such as Charleston and Morgantown in West Virginia, may have more competitive real estate markets compared to smaller towns or rural areas.

Furthermore, factors such as demand, population growth, economic conditions, and development trends can also influence the real estate market in each state. Overall, West Virginia's real estate market tends to offer more affordability, but specific dynamics can vary across regions and neighboring states.

Are there any specific amenities or attractions in West Virginia that may boost real estate value?

Yes, there are several specific amenities and attractions in West Virginia that can boost real estate value. Here are a few examples:

- Outdoor Recreation: West Virginia is known for its scenic beauty and outdoor recreational activities. Areas close to national parks, state parks, forests, or prime fishing and hunting spots can attract buyers looking for nature-related activities.

- Ski Resorts: West Virginia is home to several ski resorts, such as Snowshoe Mountain and Canaan Valley. Properties located near these resorts can see an increase in value, as they attract skiers and outdoor enthusiasts.

- Historic Sites: The state has rich historical significance, including Civil War battlefields, historical landmarks, and antique towns like Harpers Ferry. Homes in close proximity to these sites can be desirable for history buffs and tourists.

- Cultural Attractions: Cultural attractions like performing arts centers, museums, art galleries, music festivals, and theaters can contribute to an area's desirability. Towns such as Morgantown, Charleston, or Lewisburg with a strong cultural scene may witness increased real estate value.

- Waterfront Properties: West Virginia is blessed with several lakes and rivers, including the scenic New River and the Monongahela River. Properties with water access or scenic waterfront views tend to have higher value, particularly for those seeking water-related activities.

- Universities and Colleges: Neighborhoods near colleges and universities, like West Virginia University or Marshall University, often experience an increased demand for housing due to faculty, staff, and students. This can positively impact real estate values in those areas.

- Outdoor Adventure Sports: West Virginia offers abundant opportunities for outdoor adventure sports, including rock climbing, whitewater rafting, caving, and zip-lining. Properties near adventure sports destinations or facilities can leverage this demand to boost their value.

It's essential to note that real estate values can be influenced by various factors, and market dynamics also play a significant role. However, these specific amenities and attractions often contribute positively to real estate values in West Virginia.

How does West Virginia's crime rate impact real estate investments?

The crime rate in any region can have an impact on real estate investments, including in West Virginia. Here are a few ways in which West Virginia's crime rate may influence real estate investments:

- Property Values: High crime rates can negatively affect property values in an area. Potential buyers or tenants may be hesitant to invest in or live in neighborhoods with a high crime rate, leading to a decrease in demand for properties. Consequently, this reduced demand can contribute to lower property values.

- Rental Income: In areas with higher crime rates, landlords may face challenges in attracting tenants or maintaining occupancy. People may prefer to rent in safer neighborhoods, leading to higher vacancy rates and potentially lower rental income for property owners.

- Insurance Costs: Higher crime rates can result in higher insurance premiums for property owners. Insurance companies may consider areas with higher crime rates as greater risks, which could lead to increased premiums for real estate properties in those regions.

- Long-Term Appreciation: Investing in areas with high crime rates can hamper the potential for long-term appreciation in property values. Buyers and investors often seek areas with a good potential for growth and appreciation, but high crime rates can hinder this growth potential and limit the returns on investment.

- Perception and Market Perception: Crime rates can create negative perceptions and reputations for certain neighborhoods or cities, impacting the overall desirability and market perception. Such negative perceptions can discourage potential real estate investors, homebuyers, and businesses from considering these areas, affecting the overall growth and development of the real estate market.

It is important to note that while crime rates can have an impact on real estate investments, they are just one of many factors that potential investors consider. Factors like economic conditions, employment opportunities, infrastructure development, and amenities also play significant roles in determining the attractiveness of a real estate market for investments.